The Bitwise XRP ETF began trading on the New York Stock Exchange (NYSE Arca) in November 2025, marking a landmark event for both the crypto industry and traditional investors. For residents of the UAE, this opens new avenues to gain regulated exposure to XRP while benefiting from the country’s progressive crypto framework.

Understanding the Bitwise XRP ETF

- ETF Provider: Bitwise Asset Management, managing over $15 billion globally.

- Ticker Symbol: XRP

- Management Fee: 0.34% (waived for the first month on up to $500 million).

- Access: Offers spot XRP holdings, not derivatives, giving investors direct exposure to the digital asset.

- Launch Date: November 20, 2025

The ETF provides regulated access to XRP, making it a safer option for institutional and retail investors, particularly in regions like the UAE, where compliance is crucial.

Why XRP Matters?

XRP is currently the third largest cryptocurrency by market capitalization ($125 billion) and is designed to enable fast, low cost cross border payments. Key stats include:

- Over 4 billion transactions processed on the XRP Ledger

- Average daily transaction volume: $1.9 billion

- Settlement times: 3-5 seconds

For UAE investors, XRP offers both investment potential and practical utility, especially for businesses dealing in cross border transactions.

The UAE Advantage for Crypto Investors

The UAE is one of the most crypto friendly countries in the Middle East. Regulatory clarity and government support make it a prime location for investors:

- Compliance Requirements: AML, CTF and cybersecurity standards.

- Exchanges: XRP is listed on regulated UAE platforms such as BitOasis and Rain.

- Institutional Adoption: Banks, fintechs and remittance firms are integrating XRP into operations.

Ripple, the company behind XRP has secured regulatory licenses in Dubai, making UAE a strategic hub for cross border payment innovation.

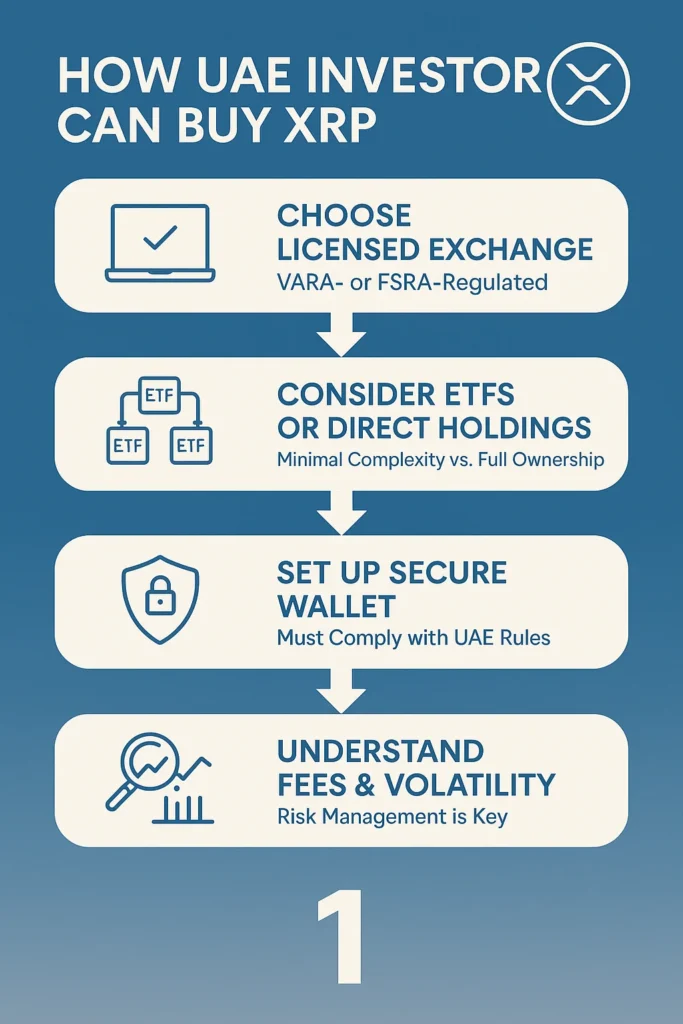

How UAE Investors Can Access XRP Safely

- Choose a Licensed Exchange: Use VARA or FSRA regulated platforms like BitOasis or Rain.

- Consider ETFs or Direct Holdings: If UAE-based XRP ETFs launch, they provide regulated exposure with minimal complexity. Otherwise, direct XRP purchases on licensed exchanges are an option.

- Set Up a Secure Wallet: For personal XRP holdings, use wallets compliant with UAE regulations.

- Understand Fees & Volatility: XRP can be volatile, consider risk management and allocation strategies.

- Track Regulatory Updates: The UAE market is dynamic, staying informed ensures compliance and safety.

Potential Impact on UAE Investors

- Institutional Interest: Analysts expect demand from local banks and investment firms, potentially driving liquidity.

- Cross Border Payments: UAE businesses can leverage XRP’s fast settlement times and low fees.

- Future ETFs: With Bitcoin ETFs already popular, XRP ETFs could be introduced locally, offering another regulated investment avenue.

Risks and Considerations

- Market Volatility: XRP is speculative and can experience significant price swings.

- Supply Concentration: Ripple Labs and early holders control large XRP quantities.

- Regulatory Changes: While the UAE is supportive, global regulatory shifts could impact XRP investments.

Conclusion

The Bitwise XRP ETF launch is transformational for the global crypto market. For UAE investors, it offers:

- Regulated and secure exposure to XRP.

- Opportunities for both investment and practical business applications.

- Access to a rapidly growing digital asset ecosystem.

By leveraging licensed exchanges, understanding risks and staying informed on regulations, UAE investors can safely tap into the XRP market while benefiting from the country’s robust crypto framework.

FAQ – Bitwise XRP ETF and UAE Investor Guide

What is the Bitwise XRP ETF?

It is an exchange traded fund (ETF) launched by Bitwise Asset Management that provides regulated, direct exposure to XRP. It trades on the NYSE Arca under the ticker XRP, offering investors a simpler way to invest in XRP without holding it directly.

Can UAE investors legally buy XRP?

Yes. UAE investors can purchase XRP via licensed exchanges like BitOasis and Rain. XRP is legally recognized in the UAE and the regulatory framework ensures compliance and safety for investors.

How is XRP different from other cryptocurrencies?

XRP is designed for fast, low cost cross border payments. Unlike many cryptocurrencies, its ledger settles transactions in 3-5 seconds, making it highly efficient for businesses and remittance services.

Should UAE investors buy XRP through ETFs or directly?

Both options are viable:

1. ETFs: Regulated, simpler and ideal for institutional or cautious investors.

2. Direct XRP: Requires secure wallets and careful risk management, but offers full exposure to XRP’s potential.

What are the main risks of investing in XRP?

Key risks include market volatility, concentration of supply (Ripple Labs and early investors) and regulatory changes, though the UAE’s framework is supportive

When could XRP ETFs be available in the UAE?

While no official XRP ETF has launched locally yet, the UAE’s regulatory clarity and growing interest suggest potential approval in the near future, similar to Bitcoin ETFs already in the market.

How can UAE businesses benefit from XRP?

XRP can streamline cross border payments, reduce transaction costs and improve settlement speed, making it practical beyond speculation.