Why Gold Prices Are Surging in 2025?

In 2025, both global and Dubai gold prices are setting new records. A mix of central bank gold purchases, persistent inflation, de-dollarization trends, and geopolitical instability has driven prices past $3,600 per ounce globally and AED 220 per gram for 24K gold in Dubai.

But what’s fueling this surge, and should investors consider buying at these levels? Let’s explore the details with data, insights, and expert opinions.

Why Gold Prices Are Rising Globally in 2025?

Here are the main drivers behind the surge:

- Declining U.S. Dollar: A weaker dollar reduces gold prices for international buyers, spurring global demand.

- Monetary Policy Uncertainty: Political interference and inflation risks push investors toward safe-haven assets.

- Geopolitical Turmoil: Wars and economic instability increase gold’s appeal as a risk hedge.

- Central Bank Demand at Historic Levels: For the first time since 1996, global reserves now hold 27% in gold versus 23% in U.S. Treasuries, with total holdings exceeding $4.5 trillion.

- Inflation Protection: Sticky inflation keeps investors interested in gold as a long-term safeguard.

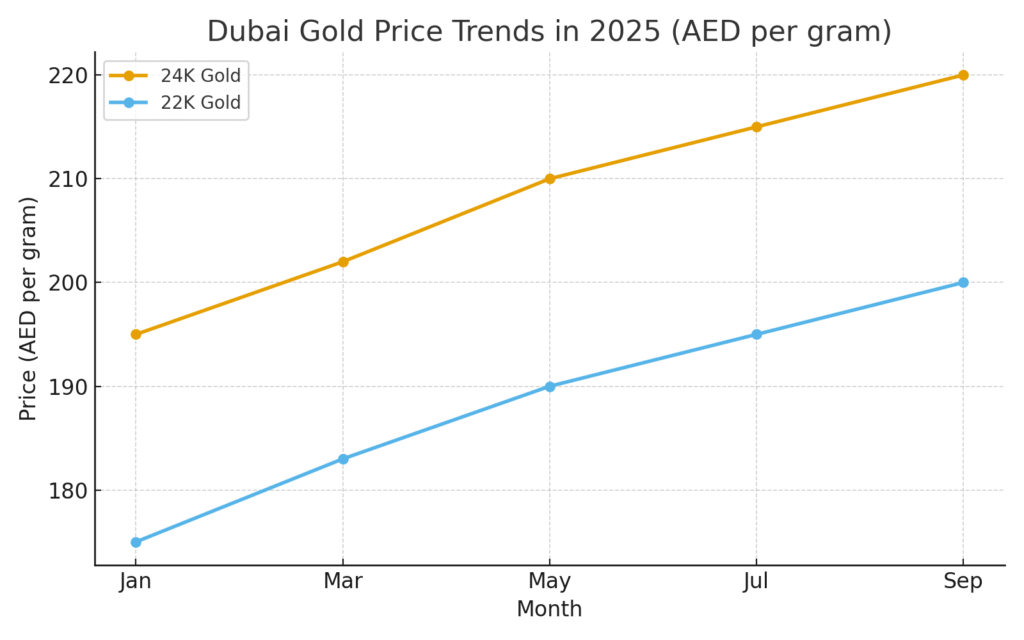

Dubai Gold Market: Local Context and Price Trends

Dubai, often dubbed the City of Gold, follows global price movements while standing out for its tax-free pricing and high local demand.

- Dubai Gold Rate (Sept 2025):

- 24K Gold → ~AED 220 per gram

- 22K Gold → ~AED 200 per gram

“We’ve seen consistent demand for gold bars and coins, with many retailers offering installment plans to support buyers during the price surge,” says Ahmed Al-Farsi, owner of Al-Souq Gold Traders in Deira.

Dubai Gold Price Trends in 2025

Central Bank & Institutional Demand: The Hidden Driver

The World Gold Council’s 2025 Global Survey revealed:

- 95% of central banks plan to expand gold reserves within the next 12 months.

- 43% are considering major allocations, reinforcing gold’s long-term appeal.

Additionally, European Gold ETFs recorded $6.5 billion in inflows in 2025, highlighting institutional confidence in gold’s value as a reserve asset.

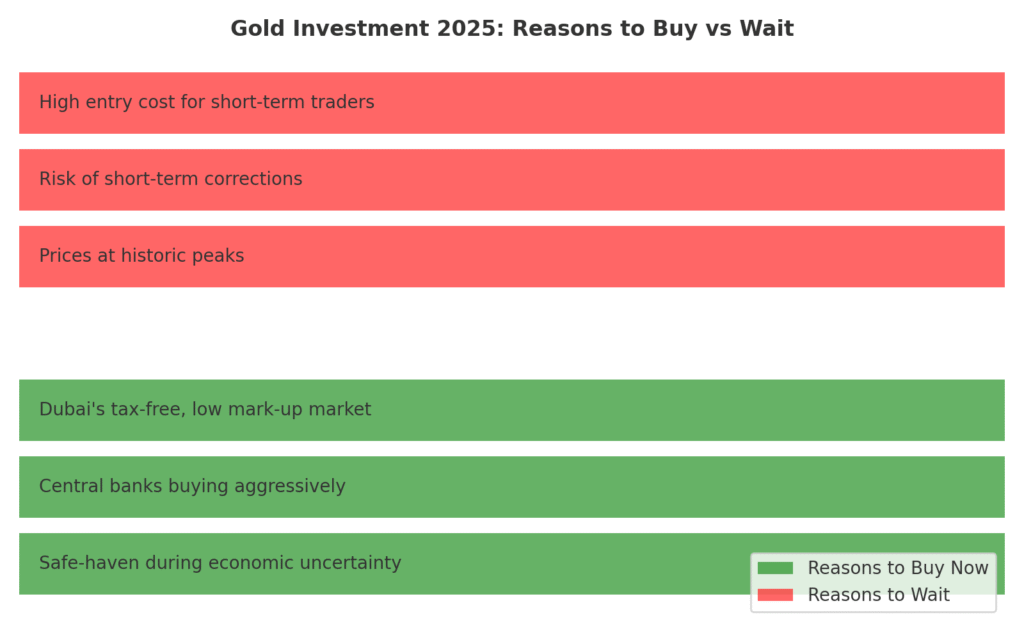

Should You Buy Gold in Dubai Now?

Reasons to Buy Now

- Gold acts as a reliable safe-haven during financial and political uncertainty.

- Central banks buying aggressively signals a long-term bullish trend.

- Dubai’s low mark-ups and tax-free policies make it one of the best markets globally.

Reasons to Wait

- Prices are at historic peaks; potential corrections can’t be ruled out.

- Short term traders may find current prices risky for quick gains.

Smart Investor Strategy Tip

To minimize risk:

- Use a Gold SIP (Systematic Investment Plan): Make small, regular purchases over time to average out price volatility.

- Diversify Holdings: Combine physical gold with liquid investment options such as Gold ETFs for easier exit strategies.

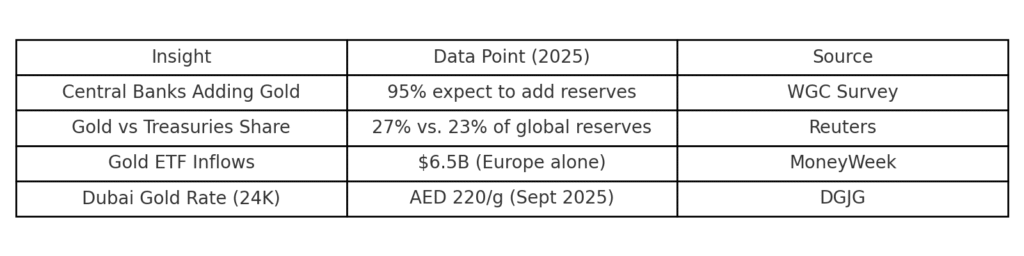

Quick Global & Local Data Snapshot

| Insight | Data Point (2025) | Source |

| Central Banks Adding Gold | 95% expect to add reserves | WGC Survey |

| Gold vs Treasuries Share | 27% vs. 23% of global reserves | Reuters |

| Gold ETF Inflows | $6.5B (Europe alone) | MoneyWeek |

| Dubai Gold Rate (24K) | AED 220/g (Sept 2025) | DGJG |

FAQs About Gold Prices in Dubai 2025

Why are Gold prices rising in 2025?

Because of inflation fears, central bank demand, geopolitical instability, and dollar weakness.

What is the Dubai Gold rate today?

In Sept 2025, 24K gold averages AED 220/g, but rates change daily.

Is Gold in Dubai genuine?

Yes, Dubai’s gold market is tightly regulated with certified dealers ensuring purity.

Should I invest in jewelry or Gold bars?

For investment purposes, bars and coins are preferred since jewelry prices often include making charges.

Will Gold prices fall soon?

Short term dips are possible, but the long term outlook remains bullish if central banks continue buying.

Final Thoughts

Dubai remains a global hub for gold buyers, offering competitive prices and secure markets even as global uncertainties drive demand higher. With central banks boosting reserves and investors diversifying into ETFs, 2025 could be the year when gold cements its status as a core wealth preservation asset.

The article offers a well rounded and insightful overview of the factors driving gold prices in Dubai in 2025. The detailed explanation of global economic influences, regional demand, and supply dynamics helped deepen my understanding. The practical buying guide is especially helpful, providing clear points to consider for both new and experienced buyers. The inclusion of local market trends and trade in advantages makes this a valuable resource for anyone looking to invest in gold in Dubai. Thank you for such an informative and transparent guide.